How Ticker grew during a pandemic

By Ticker founder and CEO, Richard King

The first lockdown was obviously a shock. No denying it: we were all glued to the news like everyone else.

But within 24 hours of the government’s announcement, 100% of Ticker staff were set up at home. We built the business to move fast and adapt to change – and it turns out that’s great for crisis management, too.

The Zoom revolution

By the end of March, we’d transitioned from office to Zoom, adopting a morning standup call for the whole business. Seeing each other first thing became a much-needed connection that I’ve strictly maintained ever since. Eleven months on, it’s a challenge to come up with something new to say every day but it’s the kickstart we all need to get our brains in gear.

Before the pandemic, I’d tried to keep all teams in one big space as far as possible, even as we grew. We’d just finished fitting out a brand-new office right before the first lockdown and it really represented how we feel as a business. The latest tech contrasting with exposed beams, lots of light, space to gather and chat – and everything focused around one huge room.

Although we’re an insurtech, so going remote was easy, it’s important to us to keep that ‘one-room’ feeling. It’s something that’s usually hard to keep hold of as businesses grow, but this period has shown us it’s possible.

Special guests

In April 2020, some special guests started joining us on Zoom.

Theo Paphitis, one of our investors, called in from his Surrey mansion and talked about the importance of considering how the world is going to change and meeting that call for innovation. Gary Lineker regaled us with football anecdotes, his adventures in cooking and embarrassing stories about our times together. Adam Parr, former Chairman of Williams F1, gave us some very philosophical chat about his current Ph.D.

Our first Zoom guest this year was Jake Wood from Eastenders, who told us how they film kissing scenes during a pandemic (Perspex screens). Useful knowledge.

The ups and downs

Mental health

However positive and prepared we were, lockdowns have been tough on everyone. Across the business, we have parents, carers, shielders – and a lot of young people facing isolation for the first time.

Something I’m very proud of is our decision to engage a psychologist long before the pandemic. We recognised that it would benefit everyone at Ticker, from the executive team to smaller groups and individuals as needed.

While we’ll always support each other, having a professional psychologist on hand has been invaluable for our wellbeing. Right away, she emphasised the importance of routine and self-care, so we’ve kept that – and things like fresh air and exercise – a high priority.

Mental health isn’t an issue that’s going anywhere. It’s taken a pandemic for many of us to realise how important our mental wellbeing is, but it’s a value Ticker will continue to hold close for the future.

Staff morale

Considering we’ve been apart for a year and even have several people who’ve never met the team in real life, we’re doing astonishingly well.

We’ve all been motivating each other to stay healthy with a kilometre challenge to keep us moving through lockdowns. The team has run, rowed, skated, danced, cycled and lunged tens of thousands of kilometres between us. This year, we thought we’d take it to a new level, adding HIIT and body balance classes with a professional trainer each week.

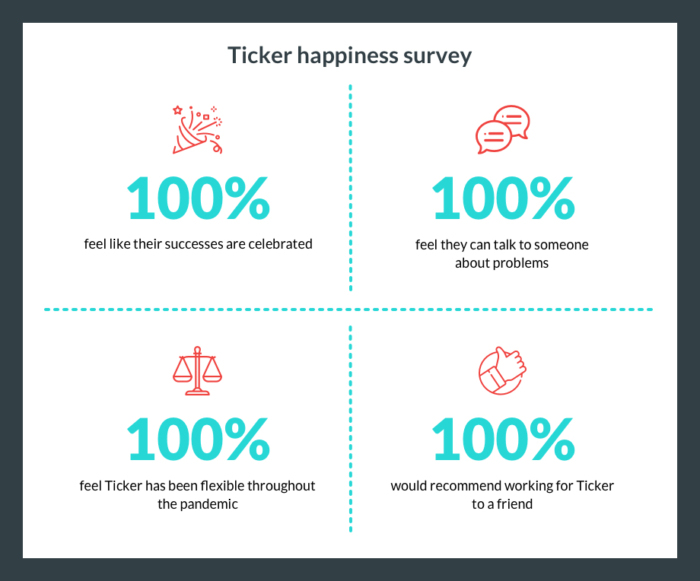

But after nearly a year apart, the exec and I wanted to give everyone the opportunity to share their anonymous feedback on how we’d handled the pandemic and their feelings about Ticker in general.

The average score for each area was 85% – which is extraordinary in normal times, let alone during a pandemic.

Of course, there are areas we want to work on. One area where we dropped the ball is upskilling, mainly because we hoped we’d be back to face-to-face sessions before long. That went to the top of the list for 2021.

Adapting

Meeting customer needs

While some insurers saw their products go quiet during the first lockdown, we were very much business as usual even as we adapted to new demands.

An example is van drivers: most of us were staring at stationary cars on the drive, but 62% of van drivers were working as much if not more than usual. There was also a huge increase in the number of people starting essential driving jobs. And where would we all be without them?

In response, we expanded our coverage to help different kinds of van drivers get insured affordably, as well as developing the product’s features as we’d planned.

Maintaining standards

As any business knows, building a good score on review sites is a gradual process, but I’m incredibly proud that our hard work is paying off. We reached ‘Excellent’ – the top rating – on Trustpilot just last week and received our second Gold Trusted Service Award from Feefo in January.

All our scoring metrics for customer service quality are where they should be, which is what our customers deserve.

Staying ahead

Theo Paphitis told us way back in April last year that innovation in a time of change can be the making of a business, and 2020 was certainly that.

As an insurtech taking connected insurance to a wider market, we’d built an ecosystem that was designed for rapid change and product development. The new normal was an opportunity to think differently about the products we had lined up.

We started considering how insurance demands were going to change very early on in the pandemic. People weren’t going to be driving as much, learners weren’t going to be taking tests – how could we evolve our offerings through the pandemic and beyond?

With two products live and six in the pipeline, our development has accelerated rather than slowed. Being able to move this quickly has meant we’re one of the lucky businesses that have seen good growth over the last year: we grew over 200% just in 2020. As well as being important financially, that’s also been important for morale. While many were struggling to tread water, we’ve managed to be more future-focused than ever.

No jobs lost, plenty of new hires and big plans for 2021.

So – what next?

A more balanced approach to work

One thing we’ve learned is that we all prefer an emphasis on homeworking. None of us fancy working solo 100% of the time but in the future, work will be split between home and the office.

We’ve got very good at running the business remotely – but we all like each other too much to go totally online.

Focus on upskilling

2020 was so much about adapting to new challenges FAST, we wanted to return to skill development in 2021. We asked our customer service team where they felt they needed to upskill and began running intensive workshops with Ticker experts.

We’ve also started whole-company knowledge sessions run by each department, so we all get to see each other’s work and learn every area of the business.

Greater inclusivity

A brilliant benefit of working remotely is that we’ve been able to widen our search when we’re recruiting. That means more candidates for us, but it also offers opportunities to a far more diverse talent pool. And a more diverse talent pool = more ideas, more innovation and more representation.

Product launches

We have several new products planned to launch this year. The pandemic has made us think differently about insurance flexibility and customer service, so we’re building propositions that answer new problems as well as issues with traditional insurance.

If 2020 was the year of change and challenge, 2021 is all about seeing the results of the hard work we’ve done together. We’ve grown: financially, as a team and as individuals.