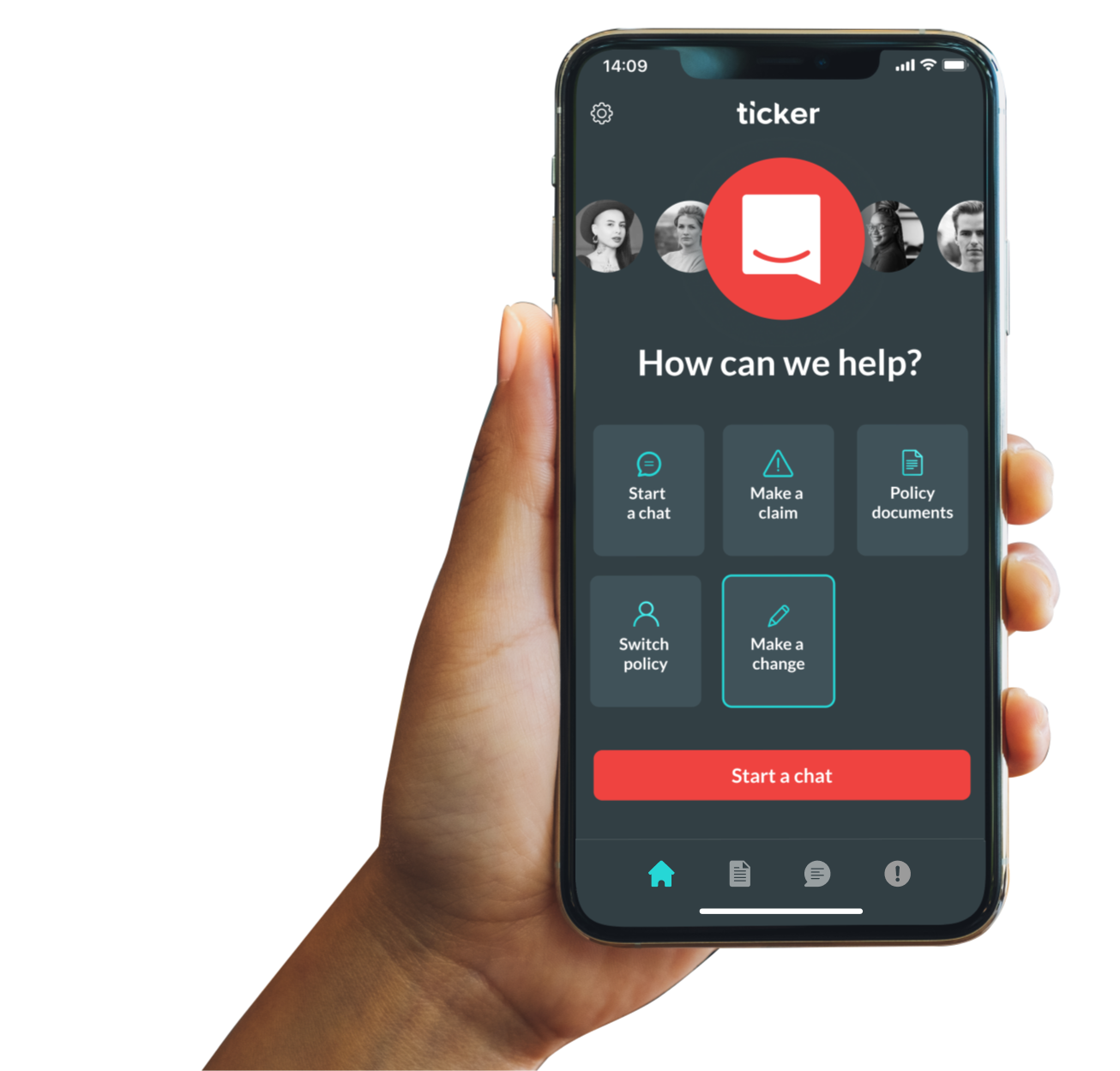

Start a chat for help

- Talk to a human for help with buying your policy

- Search hundreds of frequently asked questions

- Chat in the Ticker app if you’re already a customer

RAC Black Box Car Insurance is administered by Ticker. Start a chat about your quote or policy now.

If you report a claim within 24 hours, we’ll reduce your excess by £150. The claims team can only help with new or ongoing claims, so please start a chat if you need help with your policy.

If you need to start a claim, make sure you have these details handy to make the process as easy as possible:

Get help with buying your policy, search our FAQs or talk to us about your insurance. We’re here to help Monday to Friday from 9am to 5pm (excluding bank holidays) and 9am to 1pm on Saturdays. You can also email us at [email protected].

Monday to Friday from 8.30am to 5.30pm