Start a chat with one of our agents for sales and service

Our customer service is now by chat. We’re here from 9am to 5pm, Monday to Saturday.

Start a chat

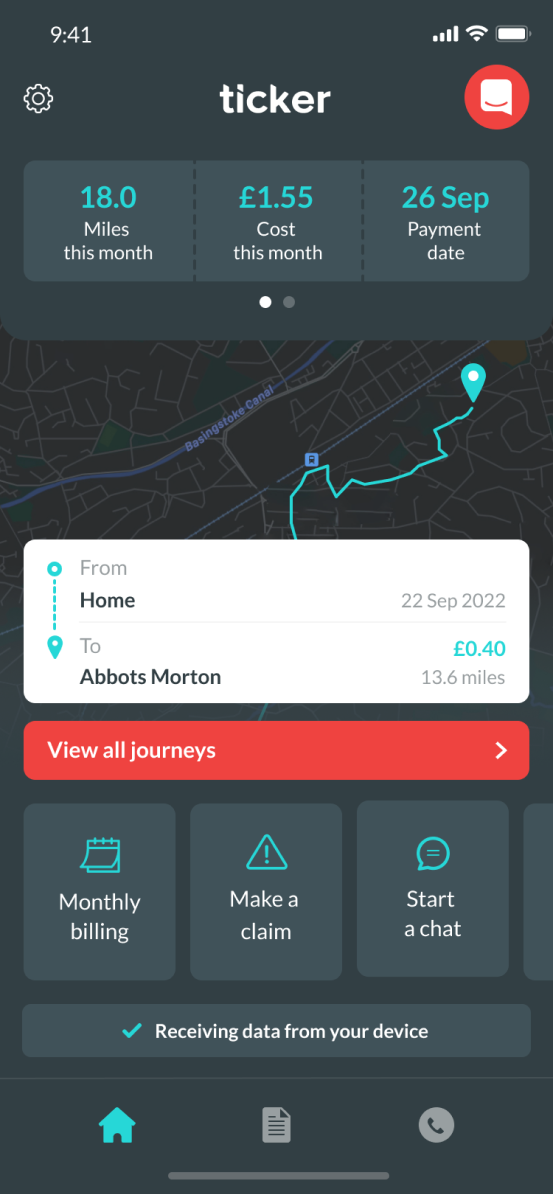

With Ticker pay-per-mile insurance, you’ll only pay for the miles you actually drive each month. No miles? No charge. Just pay as you go.

In the UK, we now drive an average of 7,000 miles a year. If you’re driving less than that, pay-per-mile could save you money on your insurance.

You declare your annual mileage as usual, but you’ll only pay for the miles you actually drive. Drive less – pay less.

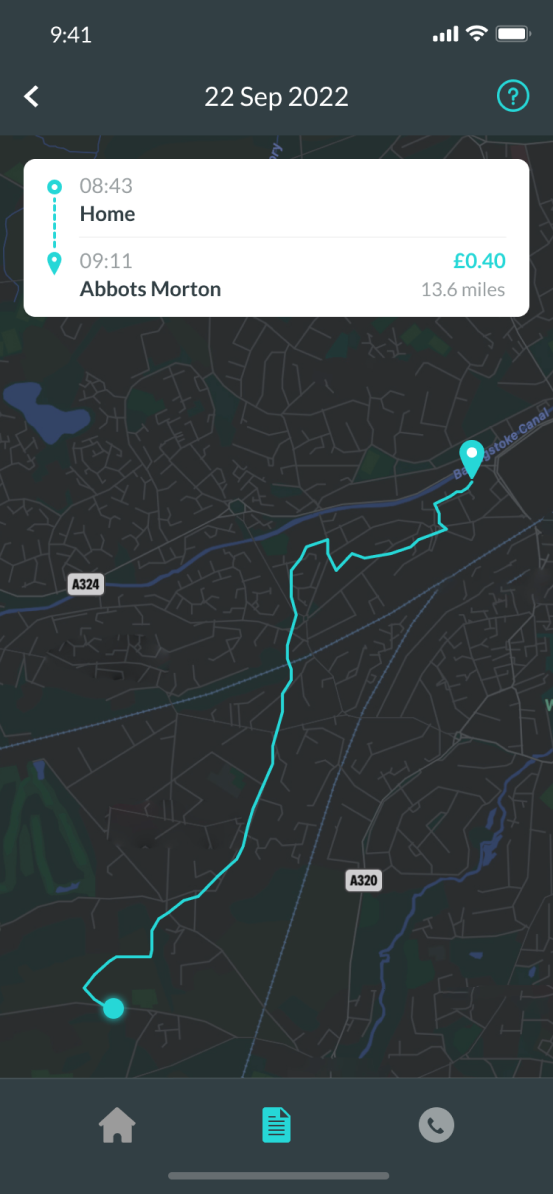

The Ticker app shows you how much each journey costs, using the mileage from your car’s odometer.

We’re only interested in the number of miles you drive, not how you drive them.

Get your quote| What’s covered with Ticker pay-per-mile insurance |

| Your parked car’s protected from theft and damage, even if your monthly bill is zero |

| Courtesy car if yours is off the road |

| Cover if you’re hit by an uninsured driver |

| Make changes to your policy yourself in the Ticker app |

| Customise with what you need | |

| RAC national roadside recovery | £65 |

| RAC full breakdown cover, including a like-for-like car | £85 |

| RAC Legal Cover for anything uninsured, like loss of earnings | £24 |

| Protect your No Claims Discount | £30 |